In the modern tech-driven world, technology plays a vital role in virtually all aspect of running a business. One area where technology has had a significant impact is in the process of obtaining business loans. For businesses in Sun City, California, understanding how technology can influence their business loan application can lead to more efficient, transparent, and favorable outcomes.

The leading financial institutions in California take advantage of advanced technology to enhance the loan application process, making it easier for businesses to get the funding they need. This blog examines the various ways technology influences your business loan application.

The Digital Transformation of Business Loan Applications

Speed and Efficiency

Online Applications

Gone are the days when business owners had to visit a bank in person to discover this apply for a loan. Today, many banks offer online application platforms. These platforms allow businesses to submit and submit loan applications from the comfort of their office or home, saving effort and reducing the burden associated with traditional applications.

Automated Processing

Advanced algorithms and automation tools can process loan applications more quickly than manual methods. This means that applications are assessed and approved more quickly, reducing businesses' waiting time. California banks’ use of automated processing systems ensures that businesses experience quick decisions on their loan applications.

Improved Accuracy and Transparency

Data Integration

Technology enables the integration of various data sources, which can be used to authenticate information provided in loan applications. This minimizes the likelihood of errors and ensures that the information is accurate. For instance, some banks can integrate financial data from accounting software or banking records to assess a business’s monetary standing.

Transparent Tracking

Online platforms often have tracking features that allow applicants to monitor the status of their loan applications instantly. This visibility helps businesses stay updated and reduces the doubt associated with the loan approval process.

Enhanced Customer Experience

User-Friendly Interfaces

Modern loan application platforms are designed with user experience in mind. Easy-to-use interfaces and clear instructions make navigating the application process easier for business owners.

Personalized Assistance

While technology enables self-service options, it also enhances personalized assistance. Many banks now have dedicated Business Banking officers who can deliver customized advice throughout the loan application process. Advanced CRM systems help these officers retrieve key details instantly, ensuring they can help clients more efficiently.

The Role of Technology in Assessing Creditworthiness

Data-Driven Decision Making

Big Data Analysis

Banks are increasingly using extensive data processing to assess the creditworthiness of loan applicants. By examining vast amounts of data, banks can gain insights into a business’s financial health, economic movements, and potential pitfalls to make data-backed lending decisions, ensuring that credit assessments are detailed and accurate.

Alternative Credit Scoring Models

Traditional credit scoring models focus on previous financial statements, which may not always give a full assessment of a business’s creditworthiness. Technology enables alternative credit scoring models that consider a wider range of factors, such as social media activity, client ratings, and business partnerships. These models can provide a more holistic view of a business’s creditworthiness, particularly for startup businesses that may not have an extensive financial history.

The Future of Business Loan Applications

Blockchain and Smart Contracts

Blockchain technology and smart contracts can potentially revolutionize the business loan application process. By providing a protected, clear, and tamper-proof record of transactions, digital ledger can streamline the loan authorization and disbursement process. Smart contracts can automate the execution of loan agreements, ensuring that capital are released only when preset conditions are met.

Enhanced Data Security

Data security becomes a essential concern as businesses become more dependent on digital platforms. Nowadays, banks allocate resources in cutting-edge cybersecurity measures to protect sensitive financial information and ensure the privacy of their clients. Future developments in data encryption and secure authentication methods will further strengthen the security of online loan applications.

Integration with Emerging Technologies

Incorporating emerging technologies, such as the IoT-connected devices and augmented reality (AR), can provide supplementary data points and insights for credit evaluations. For example, connected devices can monitor the performance of financed equipment, while virtual technology can offer remote property inspections for real estate assessments. Leading financial institutions remain committed to exploring these technologies to enhance their lending processes.

Technology has profoundly impacted the commercial loan application process, offering multiple benefits such as enhanced efficiency, precision, clarity, and better customer experience. Understanding how these technological advancements influence loan applications can lead to more effective and favorable business outcomes in Sun City, California.

Financial organizations utilize cutting-edge technology to simplify the loan application process, ensuring businesses receive the capital they need quickly and seamlessly. By adopting data-driven decision-making, advanced credit assessments, and innovative lending solutions, local banks are well-positioned to assist the varied financing needs of the local business community.

As technology evolves, the future of corporate loan applications ensures even higher efficiency, security, and availability. By staying informed about these developments, businesses can better navigate the loan application process and obtain the financing necessary for their growth and success.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Heath Ledger Then & Now!

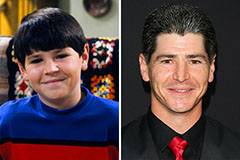

Heath Ledger Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now!